This article was written and published by The Insurer. The original is available on The Insurer’s website.

Arch is targeting further middle market growth following its acquisition of Allianz’s U.S. midcorp and entertainment business, with the carrier now better positioned to offer its broad specialty expertise to clients in the vast customer segment, Mark Lange has told The Insurer.

The Bermudian (re)insurer announced it had completed its acquisition of Allianz’s US midcorp and entertainment insurance businesses at the beginning of [August]. Around 500 staff have moved from Allianz to Arch through the deal.

Under the terms of the transaction, Arch agreed to pay $450 million in cash to acquire the operations formerly underwritten by Fireman’s Fund Insurance Company and various of its subsidiaries.

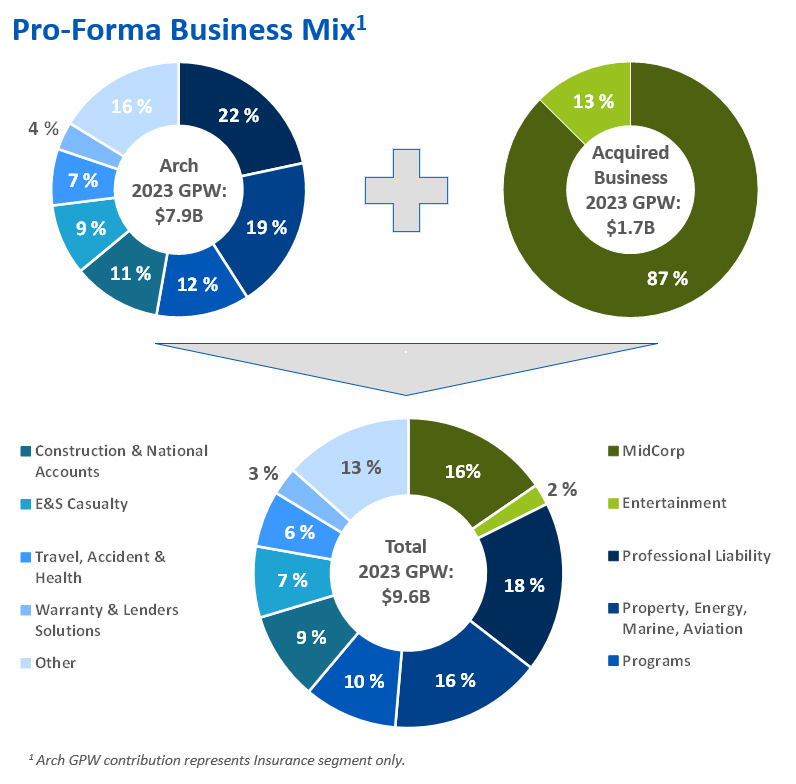

As reported at the time of the deal’s announcement in April, the units acquired by Arch collectively generated $1.7 billion of gross premium written (GPW) in 2023.

When it comes to what drove the decision to pursue the deal, Lange, chief middle market executive for Arch Insurance North America, said several years ago, Arch looked at its position in the U.S. as a specialty insurer and considered where it was, and was not, competing.

“The middle market, more standard P&C lines, was an area that we really hadn’t been playing much of a strong presence.

“We write middle market-size business through our private company D&O, cyber and so forth, but just standard lines P&C was not an area where we were really competing.”

When Arch looked at the massive middle market, Lange said the company believed there were opportunities to deploy its capabilities, and so it began making moves into the sector, including standing up businesses focused on the guaranteed cost, standard P&C lines space.

“We had some good success,” said Lange. “[But] it also highlighted some areas that we needed to make some additional investments, and so we started down the path of making those investments.”

After the possibility of acquiring the Allianz operations arose, Lange said “it really gave us the opportunity to leapfrog forward in terms of our capabilities when it comes to the product, the distribution, the claims handling”.

“The capabilities that Arch has around analytics, customer centricity, some of the products that we have, are additive to what the mid corporate and entertainment business had access to previously.” — Mark Lange, chief middle market executive, Arch Insurance North America

“It was a great way for us to really advance forward,” Lange said.

“We proved the thesis out over the first few years by doing it internally, and then the opportunity to acquire a well-established organization with good people, good reputation in the marketplace and good distribution relationships, we thought was a good way to fall forward.”

Arch is now looking to further develop the acquired Allianz operations. Lange said Arch is really strong with its technical underwriting, use of data, ability to see around the corner, and adapting how it deploys capital into the marketplace.

“The capabilities that Arch has around analytics, customer centricity, some of the products that we have, are additive to what the mid corporate and entertainment business had access to previously,” he said.

“Given the dynamics of the changing marketplace, we think those skills become especially valuable in this middle market space,” said Lange.

“Those are all things we think we can bring to layer on top of the businesses that we acquired, take it to new levels, and give it the ability to create even more solutions in the marketplace and be even more relevant to trading partners and to insureds,” he added.

Continued Entertainment Growth Planned

Drilling down into the specific operations that have been acquired, Lange said Arch will continue to support the growth of the entertainment business after Allianz leaned into that sector in the aftermath of the COVID-19 pandemic.

Of the $1.7 billion of acquired GPW, around $220 million of that GPW related to entertainment business, with the remainder focused on the U.S. midcorp sector.

The entertainment unit writes various products, including film and TV production coverage for studios and independent productions, along with live entertainment protection for shell and touring, theatre, concerts, festivals, and event promoters.

Through the transaction, Lange said the acquired Allianz entertainment business has “a leading position in the marketplace, and we’re excited about that.”

“The entertainment business is a great fit for us. It’s a niche we haven’t been in in the U.S. historically,” said Lange.

“It requires an underwriting intensity to it, it requires creativity around product and underwriting, and distribution,” he noted.

As Lange explained, the team that manages the entertainment business – the underwriters, risk control experts, distribution management specialists, and claims staff — have all moved to Arch.

The business will also be underwritten on the same forms and with matching guidelines, Lange said.

“[Entertainment is] just one of those things that’s been a gap for us. There’s not a lot of competitors, and this is a good way to get into that business. It’s got some good barriers to entry.”

A significant proportion of the acquired entertainment business’ GPW volume is generated through a capacity deal with Paragon Insurance Holdings’ Reel Media.

Since 2018, Reel Media — which Paragon acquired from 777 Partners in 2022 — has delegated underwriting authority from Allianz to underwrite studio, independent film, and television business in the U.S., among other coverages.

[Entertainment is] just one of those things that’s been a gap for us. There’s not a lot of competitors, and this is a good way to get into that business. It’s got some good barriers to entry.” — Mark Lange

Lange said with the acquisition having completed, that relationship will continue.

“It is an important part of our entertainment business,” Lange said.

The COVID-19 pandemic brought about significant losses in entertainment insurers, with concerts and shows cancelled, while television and movie filming was halted.

Some major carriers in the space scaled back or quit the market in response to the losses, but Allianz was not one of them, instead leaning into the space to take advantage of rate hardening that occurred in response to the hefty payouts.

And Lange said, “We’re going to continue that and see where we can continue to enhance that business and bring more solutions to the market.”

The Reel Media tie-up is just one of the MGA and program deals within the portfolio that Arch has acquired from Allianz.

As an investor deck detailing the acquisition outlined, within the U.S. midcorp portfolio that Arch has acquired is a book of programs business that supports MGAs writing commercial insurance — predominantly either general liability, commercial property or inland marine — for small and mid-sized firms.

Currently, that unit provides capacity to over 30 programs.

“A decent size of our book is delegated authority, [and] we’re very comfortable working in those kinds of situations,” Lange said.